HMRC (or HM Revenue & Customs) is the UK Government’s non-ministerial department for for the collection of taxes. As tax accountants Steedman and Company have a long history of dealing with HMRC. In fact our expert tax advisors are ex-HMRC tax investigators themselves.

Posts

HMRC hunt down coronavirus claim cheats who are being given 30 days to “fess up”.

HMRC, entrusted with doling out the £27 billion worth of grants and funding under the Job Retention Scheme and Self-Employment Income Support Scheme are well …

Latest update: 28 May 2020

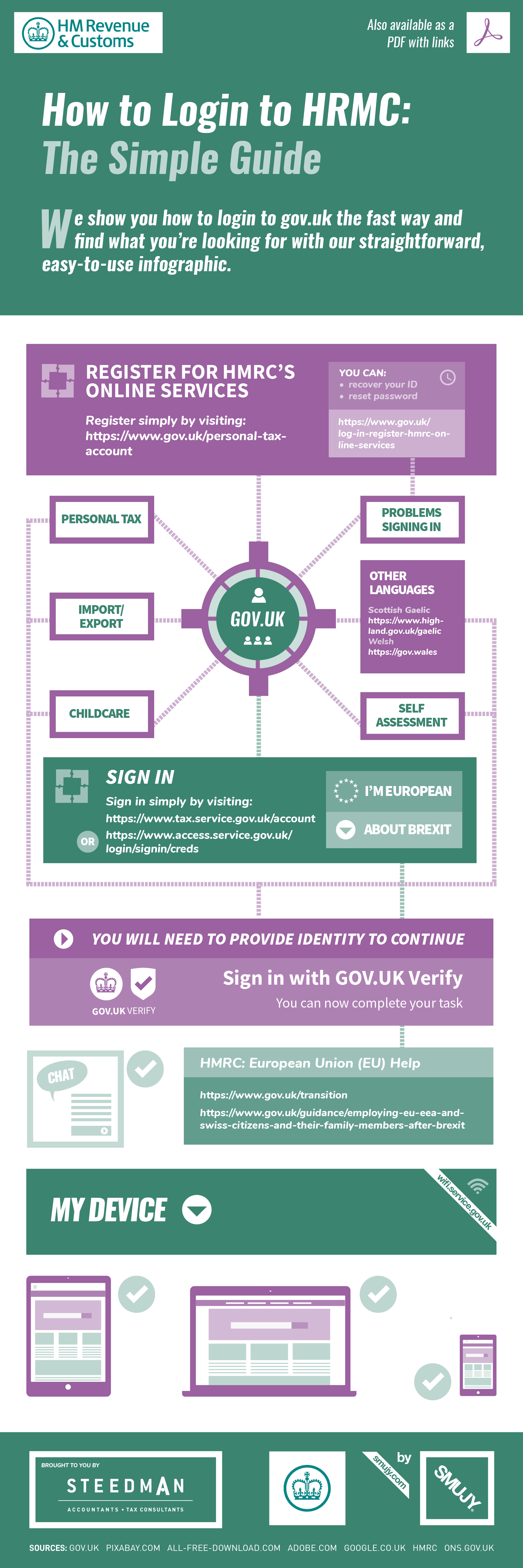

To share this infographic or to embed it in your website you can do any of the below (please note – if you wish to copy the PNG file simply right click on the image …

HMRC play the game of hide and seek using their Worldwide Disclosure Facility as overseas exercises gather pace.

Recent news stories about HMRC working with foreign tax authorities and my recent article on an Aussie couple contacting me for help …

Following on from my article on Ryanair and the pilots loan schemes the chairman of the All Party Parliamentary Loan Charge group Jim Harra, has now told campaigners that “tax officials were breaking the rule of law” in sending out …

The revelations that Ryanair pilots have become embroiled in tax avoidance schemes are just the latest in a long line of workers who signed up to be paid part of their salary through loan schemes which allowed them to take …

The gig economy probably existed before William Pitt introduced Income Tax in 1798 and gradually evolved from musicians travelling around doing gigs to the present day enigma termed ‘the gig economy’.

Now with The Revenue’s spyware and a record number

Are you affected by IR35 tax legislation? If so it is important to know the rules. IR35 is a set of rules concerning tax and National Insurance contributions if you work through an intermediary via a contract. This can be

Now that the mad rush is over for another year we can all take time to reflect on what has been a successful period not just for Steedman & Company, but also for Edinburgh as a whole.

As we have

Accelerated Payment Regime / Tax Avoidance Schemes / Code Of Practice 9 advice

With the accelerated payment scheme now brought in by HMRC this may be a good time for clients who have concealed income offshore or have been party

Edinburgh

Steedman Ltd

Headquarters

3 Queen Street

Edinburgh EH2 1JE

United Kingdom

+44 (0)131 556 8595

Mo-Fr: 9:00-17:00

Sa Su: closed

Newcastle

Steedman Ltd

Redburn Rd

9 Beaumont House, Westerhope

Newcastle upon Tyne NE5 1NB

United Kingdom

+44 (0)1912 710 827

Mo-Fr: 9:00-17:00

Sa Su: closed

London

Steedman Ltd

68 King William Street

6th Floor

London EC4N 7HR

United Kingdom

+44 (0)20 3540 1595

Mo-Fr: 9:00-17:00

Sa Su: closed