Flat Rate Scheme Changes 2017

Now that the mad rush is over for another year we can all take time to reflect on what has been a successful period not just for Steedman & Company, but also for Edinburgh as a whole.

As we have grown as a business throughout the year we have seen great things happening across the Capital. From record numbers at the city’s numerous festivals to the continued expansion of the Edinburgh Tram networks.

However, 2016 was also a year of great change with events such as Indyref and the EU Referendum causing uncertainty for those on both sides of the argument.

In the field of accountancy and tax, many changes have occurred that are going to affect all forms of business over the coming twelve months and beyond – putting pressure on tax payers and businesses like never before.

Key changes coming up in 2017 that you and your business need to look out for include:

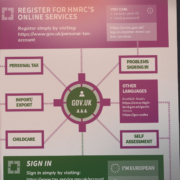

- The implementation of Making Tax Digital (MTD) by HMRC.

- The introduction of FRS 102 and FRS 105, which will replace traditional financial statements with new formats.

- Changes to the VAT Flat Rate Scheme changes 2017.

- Changes to Tax thresholds.

The changes to come are certainly daunting, even for those who have experienced the joys of Tax and Accountancy. However, we can help you overcome these barriers with a personalised approach to suit your circumstances.

For a free consultation, call 0131 556 8595 or visit our Howe Street offices in New Town. Our team is here to help.

- Steedman Accountants Charity Event in Edinburgh - March 6, 2023

- The Ethereum Merge - September 27, 2022

- Steedman & Company Launch Entrepreneurial Networking Club - September 6, 2021

Jason has over two decades of experience in accountancy, finance and technology gained in London, Edinburgh and Manchester with Deutsche Bank, Baillie Gifford, Edinburgh Partners and, most recently, BNY Mellon where he was Fund Accounting Vice President.

Jason has a BSc in Mathematics from Heriot Watt University, Investment Management Certificate (IMC), Investment Administration Qualification (IAQ), PRINCE 2 Practitioner status and is a member of the Association of Chartered Certified Accountants (ACCA).

Jason works with clients across many sectors and specialises in helping start-up companies launch and grow, implement systems and access funding and tax reliefs.