HMRC hunt down coronavirus claim cheats who are being given 30 days to “fess up”.

HMRC, entrusted with doling out the £27 billion worth of grants and funding under the Job Retention Scheme and Self-Employment Income Support Scheme are well …

Pension news often details new developments, rules and regulations related to managing pensions. From state pensions to private pensions there is always something happening in the world of pensions. Read our posts for the latest.

PAYE means Pay as You Earn. PAYE and payroll management is a main service area of Steedman and Company. In our blog we take a look at the latest developments in payroll.

Some important aspects of payroll are:

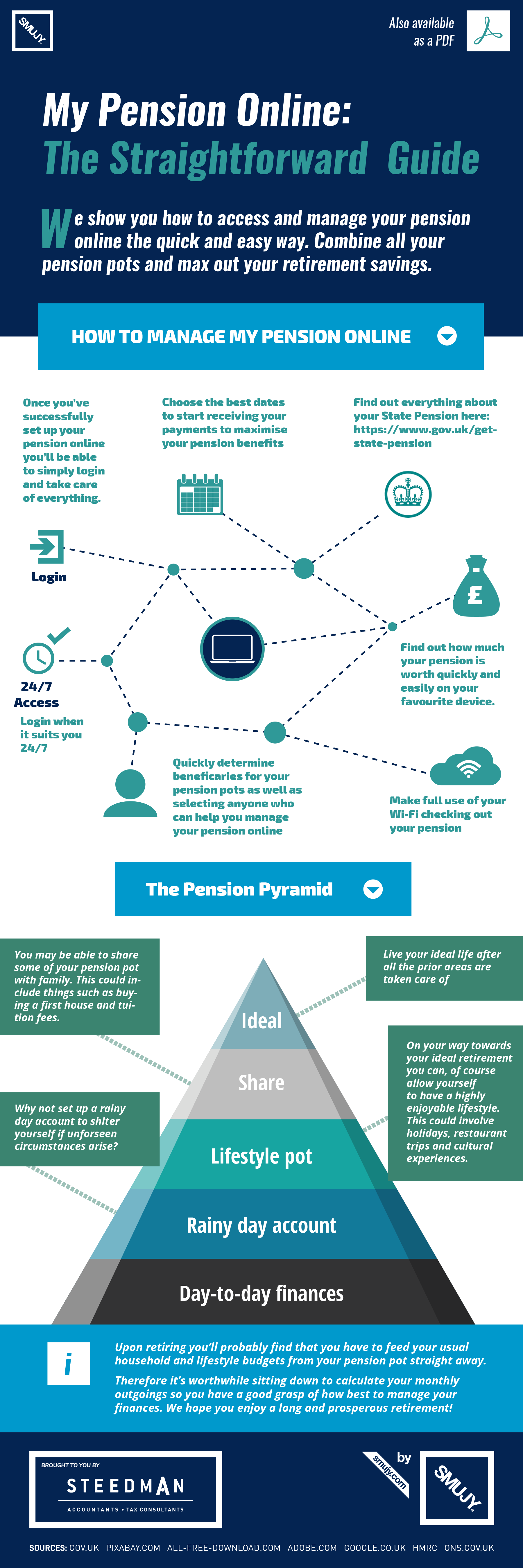

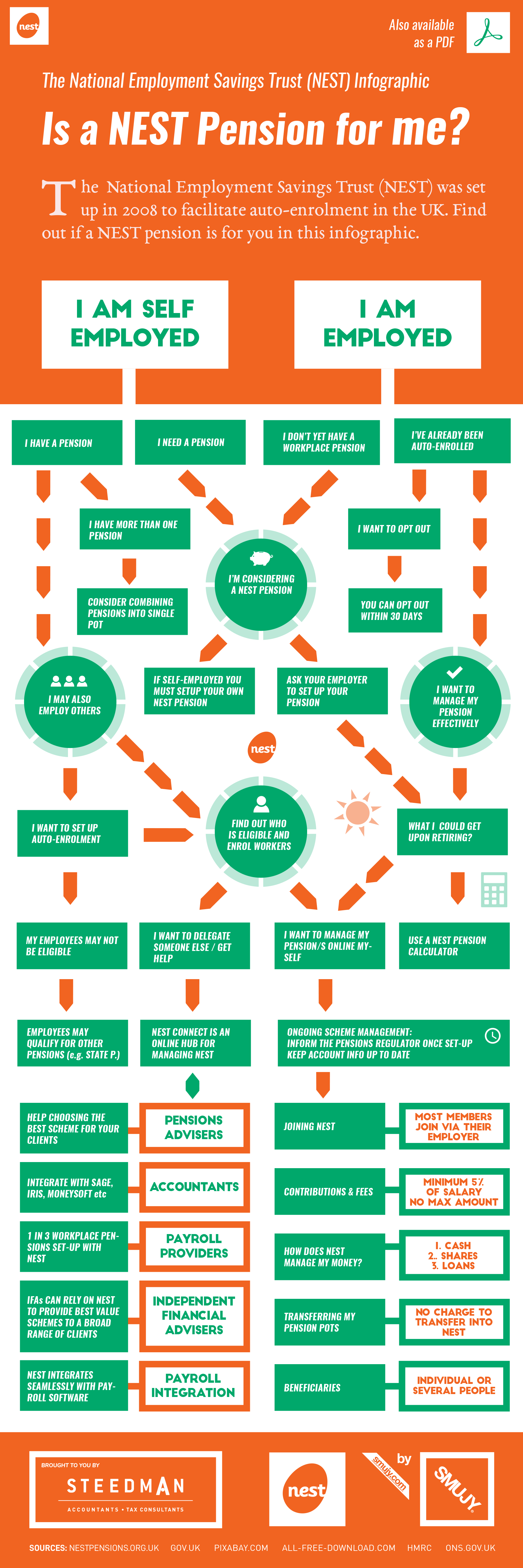

If you prefer visuals to reading text you can take a quick look at our recent infographics which give a simple overview of NEST pensions and how to manage your pension online.

If you’d like to get to grips with PAYE have a quick read of some of our articles below to find out more. If you’d like some help with your own PAYE simply get in touch.[/av_one_half]

HMRC, entrusted with doling out the £27 billion worth of grants and funding under the Job Retention Scheme and Self-Employment Income Support Scheme are well …

Latest update: 1 June 2020

To share this infographic or to embed it in your website you can do any of the below (please note – if you wish to copy the PNG file simply right click on the image …

Latest update: 22 May 2020

To share this infographic or to embed it in your website you can do any of the below (please note – if you wish to copy the PNG file simply right click on the image …

Are you affected by IR35 tax legislation? If so it is important to know the rules. IR35 is a set of rules concerning tax and National Insurance contributions if you work through an intermediary via a contract. This can be

With the accelerated payment scheme now brought in by HMRC this may be a good time for clients who have concealed income offshore or have been party

As the new tax year starts, there is welcome good news for British employers.

As of April 6, 2014, most businesses will be able to enjoy a reduction in their employer National Insurance bill by up to £2000, in the

From the 6 April 2014 you can get the Employment Allowance which could reduce your employer’s Class 1 National Insurance Contributions (NICs) by up to £2,000 every year.

Who is eligible?

Almost every employer who is a business or charity

Most people over the age of 16 pay it in one form or another but it is still an element of the UK tax system which can cause huge confusion among employees, employers and the self -employed.

National Insurance is

You may or may not be aware that the law on workplace pension schemes has changed and the Automatic-Enrolment scheme, with which all employers must comply, is currently being rolled out across the UK. This is a new piece of

Please be aware of the following changes to PAYE and NIC which take effect from 6th April 2013. If you have any questions on any aspect of this or the Real Time Information (RTI) changes, please call our Payroll team

Steedman Ltd

Headquarters

3 Queen Street

Edinburgh EH2 1JE

United Kingdom

+44 (0)131 556 8595

Mo-Fr: 9:00-17:00

Sa Su: closed

Steedman Ltd

Redburn Rd

9 Beaumont House, Westerhope

Newcastle upon Tyne NE5 1NB

United Kingdom

+44 (0)1912 710 827

Mo-Fr: 9:00-17:00

Sa Su: closed

Steedman Ltd

68 King William Street

6th Floor

London EC4N 7HR

United Kingdom

+44 (0)20 3540 1595

Mo-Fr: 9:00-17:00

Sa Su: closed