Workplace Pension Automatic-Enrolment

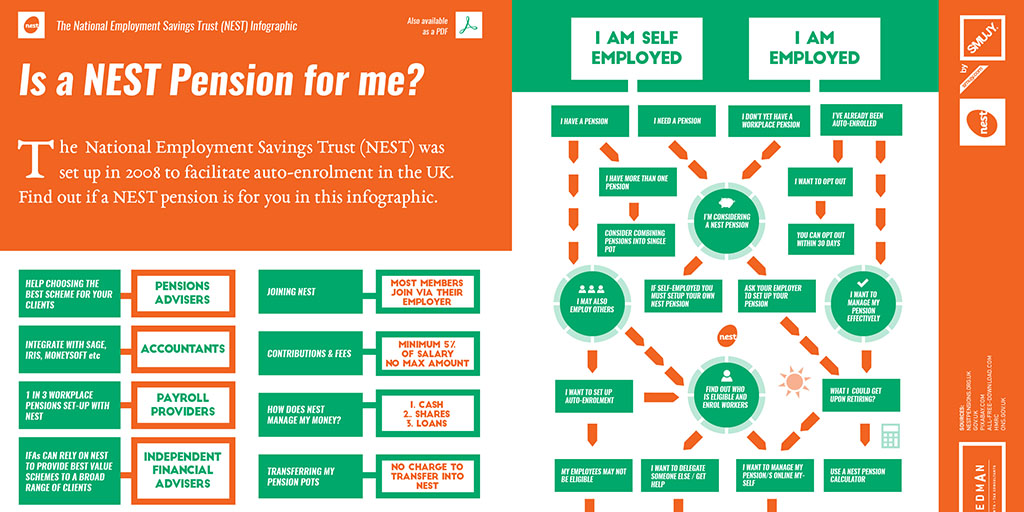

You may or may not be aware that the law on workplace pension schemes has changed and the Automatic-Enrolment scheme, with which all employers must comply, is currently being rolled out across the UK. This is a new piece of legislation which requires all employers to have a workplace pension scheme in place for their employees, even if it is just one employee, which will automatically enrol all employees into the scheme.

Your Responsibility

The Pensions Regulator are leaving the responsibility firmly on the employer to familiarise themselves with the new laws and to understand their responsibilities, requirements, key dates and deadlines.

From an employer’s point of view, it may not be a welcome change to have to start, or increase, contributions to employees’ pension plans, however, the key message about this is that it is compulsory, it is already underway, there is no way to get around it and there are heavy penalties for non-compliance.

Advice

Our view is that this is a positive change, the cost to the employer is not as significant as might first be expected and that there will be great benefits for those employers who embrace the new legislation and prepare themselves properly in advance. Conversely, any attempt to avoid dealing with the new legislation will result in severe problems further down the road.

The result for most employers is that, as a minimum, you will have to either get your existing Employer Pension Scheme looked at by a professional advisor to ensure that it is Auto-Enrolment compliant, or, if you don’t already have an Employer Pension Scheme, you will have to open one up in good time for your staging date.

We are here to help

As your accountants, we are here to help you get to grips with this change. We have churned our way through the facts and figures and we have created a factsheet which highlights the key points that you need to know and things you will need to do.

While we are here to help, we cannot stress enough the importance of you as an employer being fully aware of your new responsibilities.

If you would like more information contact us.

- HMRC Investigate Fraudulent Job Retention Scheme Claims - June 17, 2020

- Worldwide Disclosure – HMRC and Living Overseas - May 21, 2019

- UK Tax Loan Scheme for Pilots Still Up in the Air - March 20, 2019

Ricky worked as an Investigator in the Inland Revenue for over 20 years before founding Steedman & Company in 1987, giving him the experience and knowledge that enabled him to help so many clients over the years.

His appearance on a Channel 4 television programme about the inside workings of Revenue and Customs was watched by 4.1m which sealed his status as one of the most highly respected tax consultants to ever work in Scotland.

Ricky led all tax investigation and COP 9 cases, using his extensive knowledge to help people reach a positive resolution to their situation.

Ricky passed away suddenly and unexpectedly in June 2022 after leaving his indelible mark on the company he founded and headed for over 35 years.