NEST Pension Infographic

Latest update: 22 May 2020

To share this infographic or to embed it in your website you can do any of the below (please note – if you wish to copy the PNG file simply right click on the image above):

HTML

[pastacode lang=”markup” manual=”%3Ca%20href%3D%22https%3A%2F%2Fwww.steedman.co.uk%2Fwp-content%2Fuploads%2F2020%2F05%2Fnest-pension-infographic-steedman-accountant-edinburgh.png%22%20title%3D%22NEST%20Pension%20Infographic%22%3E%3Cimg%20src%3D%22https%3A%2F%2Fwww.steedman.co.uk%2Fwp-content%2Fuploads%2F2020%2F05%2Fnest-pension-infographic-steedman-accountant-edinburgh.png%22%20width%3D%22100%25%22%20style%3D%22max-width%3A%20850px%3B%22%20alt%3D%22NEST%20Pension%20Infographic%22%3E%3C%2Fa%3E%3Cbr%3EProvided%20by%20%3Ca%20href%3D%22https%3A%2F%2Fwww.steedman.co.uk%22%20target%3D%22_blank%22%3ESteedman%20and%20Company%3C%2Fa%3E” message=”Copy this HTML code to embed this infographic in your own website” highlight=”” provider=”manual”/]

iframe

[pastacode lang=”markup” manual=”%3Ciframe%20src%3D%22https%3A%2F%2Fwww.steedman.co.uk%2Fwp-content%2Fuploads%2F2020%2F05%2Fnest-pension-infographic-steedman-accountant-edinburgh.png%22%20width%3D%22100%25%22%20height%3D%22790px%22%20frameBorder%3D%220%22%20style%3D%22border%3A%200%3B%22%3E%3C%2Fiframe%3E%3Cbr%3EBrought%20to%20you%20by%20%3Ca%20href%3D%22https%3A%2F%2Fwww.steedman.co.uk%22%20target%3D%22_blank%22%3ESteedman%20and%20Company%3C%2Fa%3E” message=”Copy this iframe code to paste this infographic anywhere” highlight=”” provider=”manual”/]

Social

Share to your favourite social network/s

Further info:

NEST Pensions

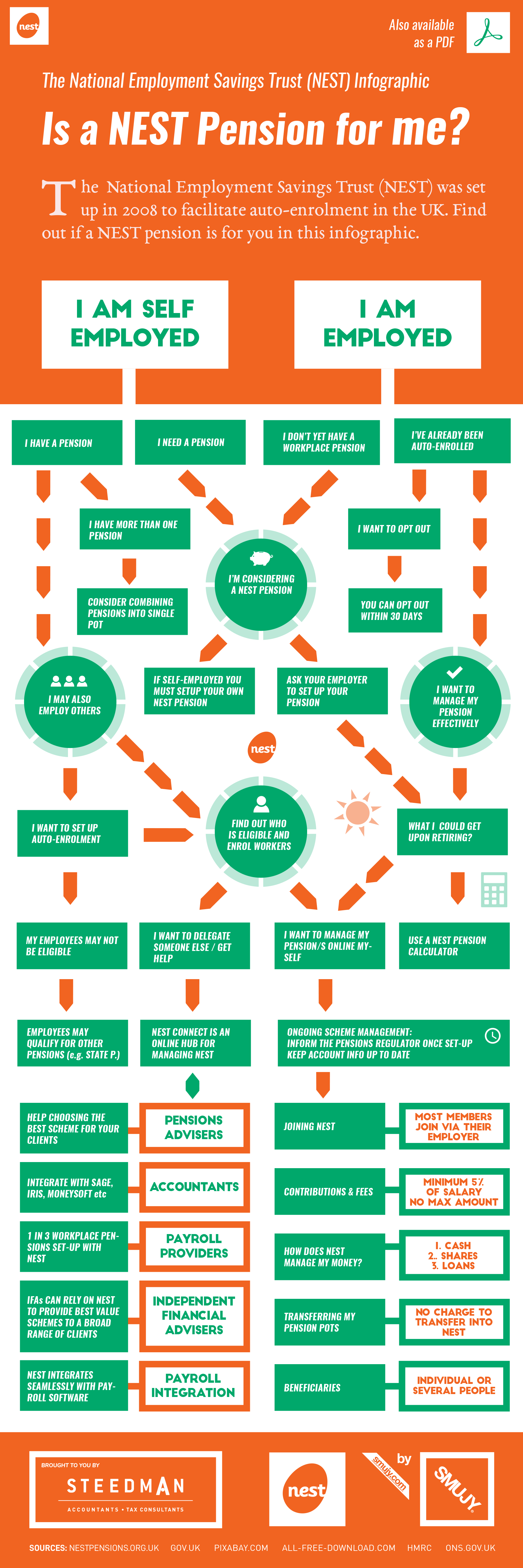

The National Employment Savings Trust (NEST) was set up in 2008 to facilitate auto-enrolment in the UK. Now that you’ve begun finding out if a NEST pension scheme is for you in our simple infographic you are well on your way towards making an informed decision.

NEST Pensions Overview

A NEST pension is a workplace pension which is set up by the government. As a member or an employer, provisioning adequate pensions for you and/or your employees has become an important aspect of operating a business.

We have listed (and expanded upon) several important topics surrounding NEST pension schemes to get you up to speed if you reckon a NEST pension is the right kind of superannuation product for you. Once you have decided if a NEST is the best UK pension product talk to one of our pensions consultants who can help you get set up with your own NEST pension login and manage your pension online.

Types of pension

Why open a workplace pension?

Tax relief advantages

How to join NEST

What if I want to opt out?

How do I transfer my pensions?

Fees

How is my money managed?

NEST pensions login – managing online

How do I grow my pension pot?

How much could I get?

How do I setup beneficiaries?

Planning my retirement

Pensions and tax

What do I do if I am a late saver?

Types of pension

We recommend reading up about the main types of pension in the UK which are:

- Defined contribution pension

- Defined benefit pension

- State Pension

Why open a workplace pension?

It is important to save for your retirement. A workplace pension is a pension scheme set up by your employer where both you and your employer make contributions.

Tax relief advantages

A workplace pension has the advantage of being able to reclaim 20p per pound as tax relief.

How to join NEST

You may be auto-enrolled by your employer or, if you are self-employed you will need to set up your NEST pension by yourself.

What if I want to opt out?

It is, of course your own choice whether to stay with your workplace pension or to opt out. If you wish to opt out this can be done up to thirty days from the time your pension was set up.

How do I transfer my pensions?

It can become fairly complicated and difficult to keep track of a multitude of different pensions. You may also be charged fees on each pension pot you have which can build up to a substantial amount over time.

It may be worthwhile for you to move your other pensions into NEST to simplify your pensions in advance of your retirement.

Fees

Although the minimum and maximum amounts that your employer (and you) contribute to your NEST pension may change between different employers the base amount for you to pay in is round about 4% of your salary.

How is my money managed?

You may wish to do some further reading about how exactly your pension pot is managed but the basics are as follows:

- A cash amount

- Loans to large institutions and firms

- Shares

NEST pensions login – managing online

With your own NEST pension login you can control all aspects of your pension with ease. As well as being able to see your current balance you can quickly add others to help you manage your pension if need be, change your details and alter the amount you are paying in.

How do I grow my pension pot?

Expanding your pension balance is, of course an important part of looking after your pension going forward. Factors such as the exact nature of the retirement you’re planning on and how much you can currently pay in will help guide your decision making.

How much can I get?

Upon the activation of your pension (when you begin drawing funds) you may want to consider how taxes may affect your pension. We recommend using the NEST pension calculator to work this out.

How do I setup beneficiaries?

You can nominate who you would want your pension to go to when you die.

Planning my retirement

An obvious thought when planning the retirement you are hoping for is what age you will retire at. Your future plans, living circumstances and the age you will be when you cease working are all important considerations.

Pensions and tax

Pensions are subject to tax depending on the nature of your pension plan, the amount you have built up and your plans for your retirement income.

What do I do if I am a late saver?

If you are in your fifties, or even your sixties you can still save towards your retirement. No matter when you begin paying into your pension pot you will greatly improve your chances of having an enjoyable retirement when the time comes.

- Crypto Taxes: An International Guide - April 1, 2022

- My Pension Online Infographic - June 1, 2020

- HMRC Login Infographic - May 28, 2020

Russell Steedman is a digital designer and online content creation specialist. Russell works as an outsourced Marketing Manager for Steedman and Company.

It’s quite a neat way to layout all the options. You have mentioned this but I’d imagine your readers want to see more about what is happening with their money i.e. how is it invested and so on. Also more info on how people can withdraw their funds when reaching pension age would be useful too, thanks

So Nest pensions are a form of state pension? I’m confused.