Latest update: 1 June 2020

To share this infographic or to embed it in your website you can do any of the below (please note – if you wish to copy the PNG file simply right click on the image …

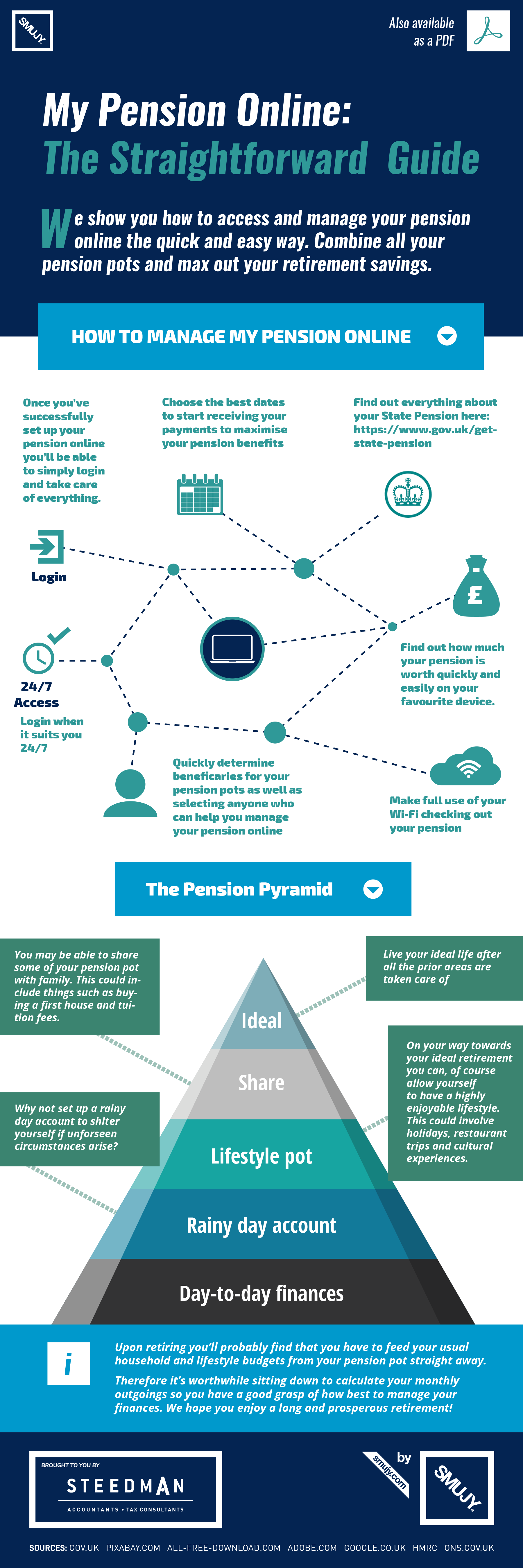

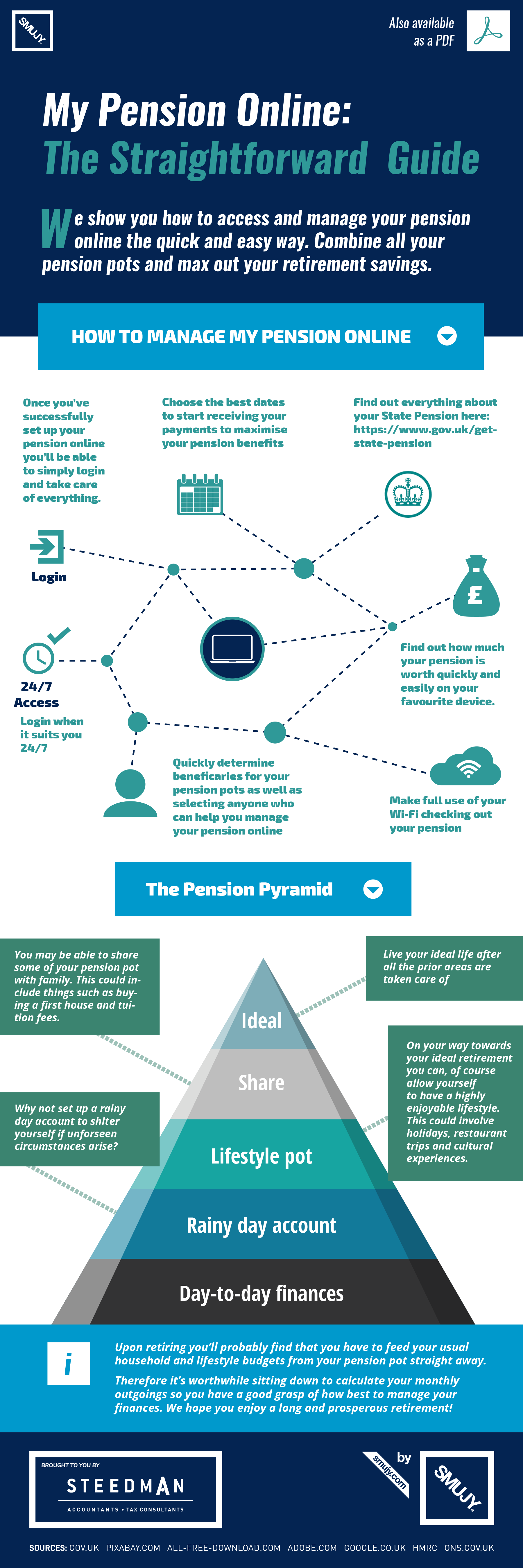

Setting up your workplace, private or other type of pension entails a certain amount of work but is likely to pay off in the long run.

Latest update: 1 June 2020

To share this infographic or to embed it in your website you can do any of the below (please note – if you wish to copy the PNG file simply right click on the image …

Latest update: 22 May 2020

To share this infographic or to embed it in your website you can do any of the below (please note – if you wish to copy the PNG file simply right click on the image …

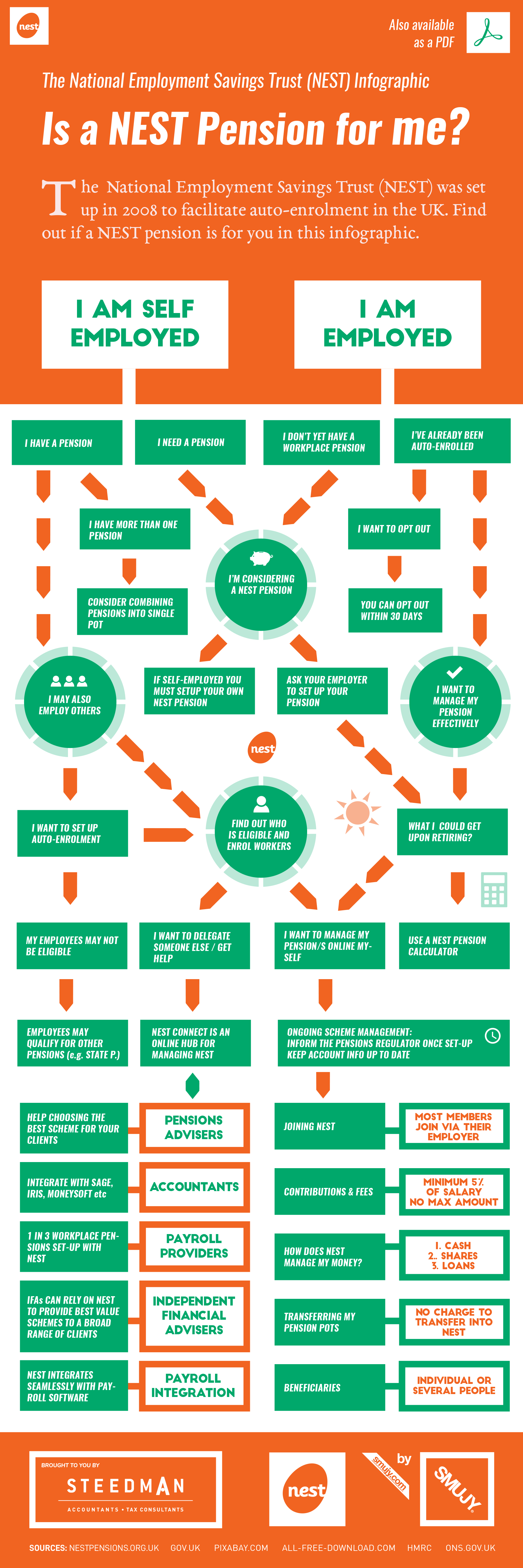

You may or may not be aware that the law on workplace pension schemes has changed and the Automatic-Enrolment scheme, with which all employers must comply, is currently being rolled out across the UK. This is a new piece of

Self employed people could be amongst the winners of the government’s new single tier pension.

The white paper details plans to change the current £107.45 basic pension with various tops up, to a flat rate of £144 from 2017 at

Public sector workers will have to work longer and pay more into their pension funds if they want to continue to receive better pensions than those in the private sector, the chief secretary to the Treasury, Danny Alexander has said.…

UK Independent Auditors are not obliged to tell pension scheme trustees about intricate details regarding their schemes. Savers are ultimately responsible for checking and reviewing their own statements and making sure that things are as they expect.

It is essential …

New legislation will be passed to prevent employers from being able to force staff to retire at the age of 65.

The move, which will commence in October, was declared as being “great news” for older people, the economy and …

As many as 4 million people could be affected by government plans to allow private sector final salary schemes to increase pension payments in line with consumer prices index (CPI), rather than the more generous retail prices index (RPI).

Pensions …

All UK businesses will have to offer company pension schemes by the year 2016, the government has agreed. They can either offer their own company scheme or enrol staff into the National Employment Savings Trust (Nest).

This will result in …

A think tank has warned that the age people can claim the state pension has to rise to 72 if it is to be in line with the increase in life expectancy.

The Pension Policy Institute (PPI) said in the …

Steedman Ltd

Headquarters

3 Queen Street

Edinburgh EH2 1JE

United Kingdom

+44 (0)131 556 8595

Mo-Fr: 9:00-17:00

Sa Su: closed

Steedman Ltd

Redburn Rd

9 Beaumont House, Westerhope

Newcastle upon Tyne NE5 1NB

United Kingdom

+44 (0)1912 710 827

Mo-Fr: 9:00-17:00

Sa Su: closed

Steedman Ltd

68 King William Street

6th Floor

London EC4N 7HR

United Kingdom

+44 (0)20 3540 1595

Mo-Fr: 9:00-17:00

Sa Su: closed